WHT Dividends 1 Interest 2 Royalties 3a 3b Special classes of incomeRentals 4 5 Resident. Chargeable income MYR CIT rate for year of assessment 20212022.

Gst In Malaysia Will It Return After Being Abolished In 2018

Country-by-country CbC reporting.

. These companies are taxed at a rate of 24 Annually. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Dealing with Malaysia entities is allowed with a tax rate of 3.

ITA of 100 for five years for existing companies in. HMRC Corporation Tax CT600 Filing return CT600 Account and Companies House accounts. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

An individual is considered tax resident if heshe is in Malaysia for 182 days or more in a calendar year. A company is tax resident in Malaysia if its management and control are exercised in Malaysia. Company with paid up capital more than RM25 million.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Bayaran Taksiran LBATA 24Aktiviti Perdagangan 27. Malaysian entities of foreign MNC groups will generally.

The Malaysian companies which transact with a Labuan entity are entitled to a tax deduction on. The current CIT rates are provided in the following table. Management and control are normally considered to be exercised at the place where the directors meetings concerning management and control of the company are held.

The increased tax rate does not apply to the disposal of low cost medium low and affordable residential homes at valued below RM200000 by Malaysian citizens. The CbC Rules require that Malaysian multinational corporation MNC groups with total consolidated group revenues of MYR 3 billion to prepare and submit CbC reports to the tax authorities no later than 12 months after the close of each financial year. Corporate Tax The common corporate tax rate in Malaysia is 25.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. This rate is relatively lower than what we have seen in the previous year. Ad Corporation Tax calculation and instant iXBRL tagging for small companies.

In general corporations are taxed on income derived from Malaysia with the exception for banking insurance air transport or shipping sectors. The existing tax exemption for interest earned on wholesale money market funds will cease with effect from 1 January 2019. Malaysian citizen or permanent resident increased from 0 to 5.

Company with paid up capital not. Last reviewed - 13 June 2022. Tax Rate of Company.

Income attributable to a Labuan business. Corporate tax highlights. Ad Corporation Tax calculation and instant iXBRL tagging for small companies.

The ad valorem rates are 5 or 10 depending on the class of goods. 24 Year Assessment 2017 - 2018. Tax Rate of Company.

Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company. Tax Rate of Company. 0 tax rate for 10 or 15 years for new companies that invest a minimum of MYR 300 million or MYR 500 million respectively in the manufacturing sector in Malaysia.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. The rate of service tax is 6. The Latest Labuan Tax 2019 changes effective from 1st January 2019 is as follows.

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. Company with paid up capital not more than RM25 million On first RM500000. Resident companies are taxed at the rate of 24 while those with paid-up capital of.

See Note 5 for other sources of income subject to WHT. Company non-citizen and non-permanent resident individual increased from 5 to 10. Bayaran Taksiran LBATA 24Aktiviti Bukan Perdagangan Company.

13 rows 30. Corporate - Taxes on corporate income. HMRC Corporation Tax CT600 Filing return CT600 Account and Companies House accounts.

Taxable income comprises all. The following incentives are given to encourage investment and relocation of manufacturing or services operations into Malaysia. The flat tax fee of RM20000 is abolished for trading companies including all licensed entities.

Malaysia Corporate - Withholding taxes Last reviewed - 13 June 2022. Service tax is a consumption tax levied and charged on any taxable services provided in Malaysia by a registered person in carrying on ones business. Company Taxpayer Responsibilities.

Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. Small and medium enterprises SMEs pay slightly different company tax as compared to other resident companies.

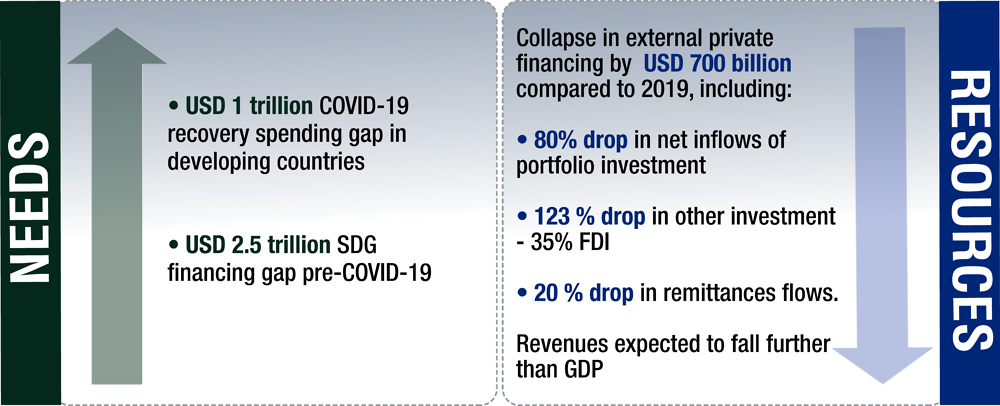

Overview Global Outlook On Financing For Sustainable Development 2021 A New Way To Invest For People And Planet Oecd Ilibrary

Company Tax Rates 2022 Atotaxrates Info

Epf Declares Dividend Of 6 10 For 2021 Above Pre Pandemic 2019 The Edge Markets

Top Fdi Trends In Southeast Asia Uob Asean Insights

2020 E Commerce Payments Trends Report India Country Insights

Qatar Currency Timeline Exchange Rate All About Qatari Riyal Qatar Currency Qatari

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Corporate Income Tax Rate Tax In Malaysia

Bigwin Cuci Rm5000 Ikang News Games Fortune

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Un Desa Policy Brief No 129 The Monetary Policy Response To Covid 19 The Role Of Asset Purchase Programmes Department Of Economic And Social Affairs

T20 M40 And B40 Income Classifications In Malaysia

Italy Government Debt To Gdp 2019 2022 Statista

2019 Insurance Industry Outlook Deloitte

Sme Corporation Malaysia Sme Corp Malaysia Quarterly Survey

Malaysia Sst Sales And Service Tax A Complete Guide

With The New Year Approaching Quickly It Is Imperative To Get Your Things In Order So You Have Ample Time To M Investing Property Investor Investment Property